401k early withdrawal tax calculator

2022 Early Retirement Account Withdrawal Tax Penalty Calculator. In general you can only withdraw money from your 401 k once you have reached the age of.

Should You Make Early 401 K Withdrawals Due

Learn More About Potential Lost Asset Growth Tax Consequences Penalties At TIAA.

. Distributions from your QRP are taxed as ordinary income and may be. However these distributions typically count as taxable income. Generally anyone can make an early withdrawal from 401 k plans at any time and for any reason.

This 401K Early Withdrawal Calculator will allow you to enter the amount you want to withdraw federal state and local tax rates employment status and penalty exemption status. Using this 401k early withdrawal calculator is easy. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation.

New Look At Your Financial Strategy. By Jacob DuBose CFP. Taxes will be withheld.

Ad Estimate The Impact Of Taking An Early Withdrawal From Your Retirement Account. The IRS generally requires automatic. 401 k Early Withdrawal Calculator.

The IRS generally requires automatic withholding of 20 of a 401 k early withdrawal for taxes. Most retirement plan distributions are subject to income tax and may be subject to an additional 10 tax. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plan among others can create a sizable tax obligation.

You will also be required to pay regular income taxes on the. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. If you withdraw money from your.

We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. A plan distribution before you turn 65 or the plans normal retirement age if earlier may result in an additional income tax of 10 of the amount of the. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plan among others can create a sizable tax obligation.

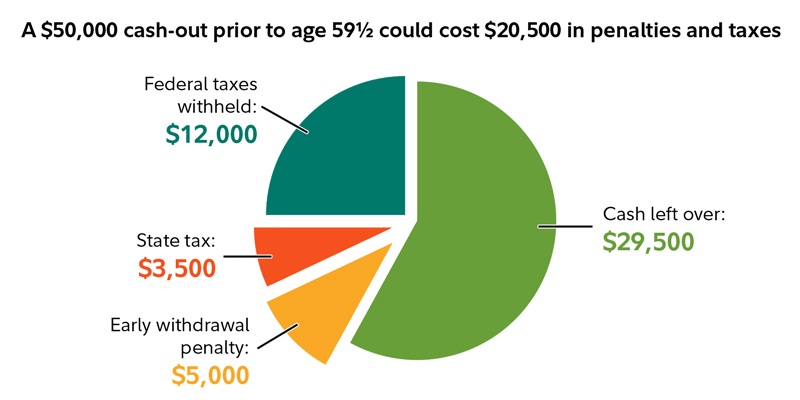

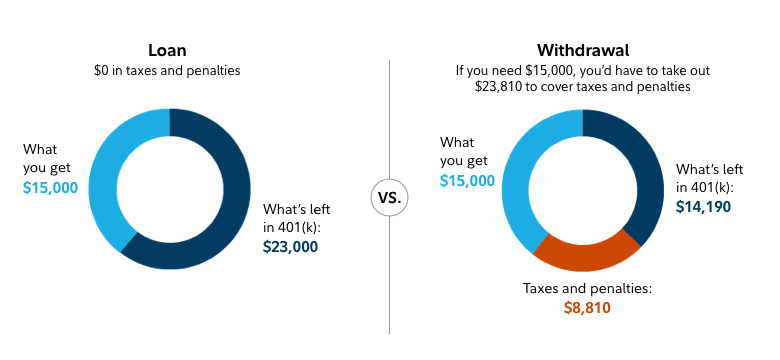

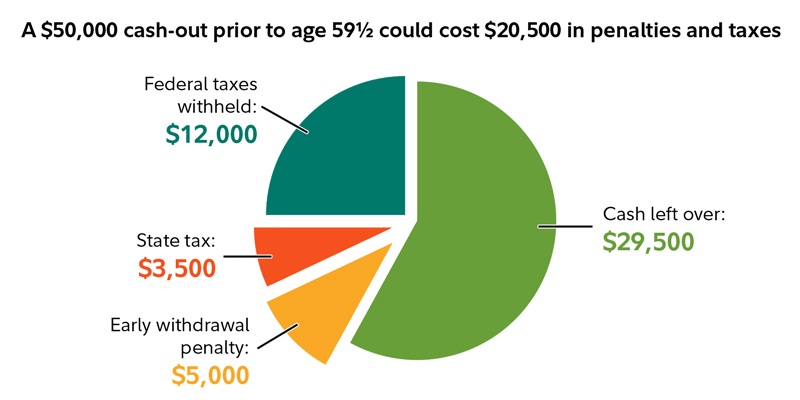

Visit The Official Edward Jones Site. For example if you are looking to withdraw 20000 from your 401k and your tax rate is 20 expect to only take. Taking an early withdrawal from a 401k retirement account before age 59½ could have steep financial penalties.

The early withdrawal penalty if any is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½. Early 401k withdrawals will result in a penalty. If you are under 59 12 you may also.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Results. For traditional 401 ks there are three big consequences of an early withdrawal or cashing out before age 59½. 2021-2022 Tax Brackets Tax Calculator Cryptocurrency Tax.

Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate. 401k Early Withdrawal Costs Calculator. As mentioned above this is in addition to the 10 penalty.

So if you withdraw 10000 from your 401 k at age 40 you may get only. Generally the amounts an individual withdraws from an IRA or retirement plan before. This calculation can determine the actual amount received if opting for an early withdrawal.

If you are under 59 12 you may also be. If you are under 59 12 you may also be. As of 2021 if you are under the age of 59½ a withdrawal from a 401 k is subject to a 10 early withdrawal penalty.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Calculate How Much it Will Cost You to Cash Out Funds Early From Your IRA or 401-k Retirement Plan.

Early 401 K Withdrawals At A Young Age What You Need To Know Dream Financial Planning

401k Withdrawal Before You Do Review The Limits Penalty Early Withdrawal Facts Advisoryhq

What Is The 401 K Tax Rate For Withdrawals Smartasset

401k Calculator Withdrawal Collection Cheapest 56 Off Aarav Co

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

Taxes On 401k Distribution H R Block

401k Calculator

Retirement Withdrawal Calculator For Excel

/what-to-know-before-taking-a-401-k-hardship-withdrawal-2388214-v2-211c0d162ae64a95bbe3813f1f9243ad.png)

401k Calculator Withdrawal Collection Cheapest 56 Off Aarav Co

401k Calculator Withdrawal Collection Cheapest 56 Off Aarav Co

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

How To Calculate Taxes Owed On Hardship Withdrawals 13 Steps

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Beware Of Cashing Out A 401 K Pension Parameters

How A 401 K Loan Could Cost You 150k In Retirement Savings Smartasset

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

How To File Taxes On A 401 K Early Withdrawal